TRN Secures Federal Trademark Registration, Reinforcing Trust in Tax Resolution Services

USPTO registration strengthens consumer confidence in Tax Relief Negotiators as IRS enforcement accelerates and tax resolution risks rise.

USPTO registration provides independent verification of our identity and reinforces accountability in tax resolution services.”

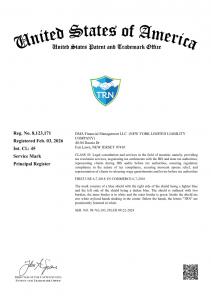

NEW YORK, NY, UNITED STATES, February 5, 2026 /EINPresswire.com/ -- As taxpayers face increasingly automated and accelerated enforcement from the Internal Revenue Service, Tax Relief Negotiators (TRN) announced that its TRN service mark has been officially registered on the Principal Register of the United States Patent and Trademark Office (USPTO) under Registration No. 8,123,171.— Dmytro Arshynov, Founder, Tax Relief Negotiators

The federal registration formally recognizes TRN as a protected service mark covering tax resolution and legal consultation services, including negotiating tax settlements with the IRS and state tax authorities, representing clients during IRS audits, securing regulatory compliance, obtaining innocent spouse relief, and representing taxpayers in releasing wage garnishments and levies.

In an industry frequently scrutinized for misleading claims and unverified providers, USPTO registration serves as an independent government validation of a firm’s identity, scope of services, and continuous use in commerce.

“Tax resolution is a high-risk area for consumers, especially as IRS collections become faster and more automated,” said Dmytro Arshynov, founder of Tax Relief Negotiators. “Federal trademark registration helps distinguish established, compliant firms from unregistered operators and reinforces accountability to the public.”

Why Trademark Registration Matters in Tax Problem Resolution

Registration on the USPTO Principal Register provides nationwide legal protection and confirms exclusive rights to the TRN mark for the covered services. For taxpayers, this reduces confusion and helps verify that the firm handling sensitive IRS matters is operating under a federally recognized identity.

Tax Relief Negotiators’ registration reflects first use and use in commerce dating back to June 7, 2018, demonstrating long-standing operation prior to formal registration — a factor often associated with stability and reliability in professional services.

As IRS enforcement increasingly relies on automated systems and shortened response windows, taxpayers often must act quickly when selecting representation. Verifiable credentials, regulatory alignment, and transparent service scope are becoming critical indicators of trust.

Supporting Informed Decision-Making

Tax Relief Negotiators operates nationwide, assisting individuals and businesses with complex tax problems through compliance-driven resolution strategies. The firm emphasizes education, documentation, and lawful negotiation when interacting with tax authorities.

The USPTO registration adds an additional layer of public verification at a time when taxpayers are encouraged to carefully evaluate who they trust with IRS negotiations, financial disclosures, and enforcement defense.

Additional registration details for the TRN service mark are publicly available through the USPTO Trademark Status and Document Retrieval (TSDR) system.

Dmytro Arshynov

Tax Relief Negotiators

+ +1 888-375-2848

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

TikTok

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.